PURE EDUCATION • ZERO COMMISSIONS • ZERO ASSET FEES

PURE EDUCATION

ZERO COMMISSIONS

ZERO ASSET FEES

Which Path Is Yours?

The Clear & Simple Path

(0% → 90%)

For investors who want a simple, robust, easy-to-implement foundation that just works

You're standing at the starting line, lost in a wall of confusing jargon and conflicting advice. You know you need to invest, but you're paralyzed by the fear of making a simple mistake that could cost you thousandsMy Clarity Guide: 4-Step to Go from Confused to Confident, is a 5-page guide where you will learn how to build a simple evidence-based portfolio, that gets you 90% of the result for a fraction of the complexity and cost

The Optimized Path

(90% → 99%)

For experienced investors seeking institutional-grade performance and customization options

You have mastered the fundamentals, and now want to go beyond basic strategies.

Deploy the advanced frameworks used by endowments to capture risk premia, optimize for factor exposure, and engineer a portfolio that solves for complex liabilities.The Strategic Session is an intensive 90-minute masterclass designed to upgrade your decision-making with the math, models, and dynamic strategies required for institutional-grade execution.

Your Uncertainty is Their Profit.

When it comes to investing, the financial industry has built a complex machine designed to confuse you and extract fees. A sad we've all come to accept.

As an investor you are faced with maze of countless options and a thousand ways to mess up. You know the risk of a single mistake is simply something your cannot afford. This paralyzing fear leads to one of two outcomes: inaction or mediocre results.

The industry knows this. They sell complexity at high fees, reassure you that "it's in good hands," and bet on your dependence for life. Their goal isn't your financial success, it's to keep you as a recurring revenue stream.

The Compounding Cost of Inaction

This leak doesn't just get worse. The wealth you lose is gone forever.

For many of us, we remain paralyzed, letting our hard earned savings get eaten alive by inflation or fees every single day. In other cases, we ask a friend to help us build a portfolio we don't understand and have zero confidence in. The moment the market drops, we panic, question everything, and sell at the worst possible time. our plan never recovers from this.

If you're lucky to have a bit more experience, you face another issue. You're constantly tinkering, bleeding wealth to hidden inefficiencies. You lack deep confidence in your strategy, so when it underperforms, you're always tempted to change it at exactly the wrong time. Sometimes you break the pipe trying to fix it, and end up doing worse than the default option.

A Different Approach, Built on Education and Integrity.

Because the Best Steward of Your Capital Should Be You.

After 7+ years inside the financial industry here in Luxembourg, from fund audit to managing ETFs, I saw a fundamental problem: the system isn't always designed for your success. Too often, sophisticated professionals see their hard-earned wealth eroded by hidden fees, complex jargon, and advice conflicted by commissions.

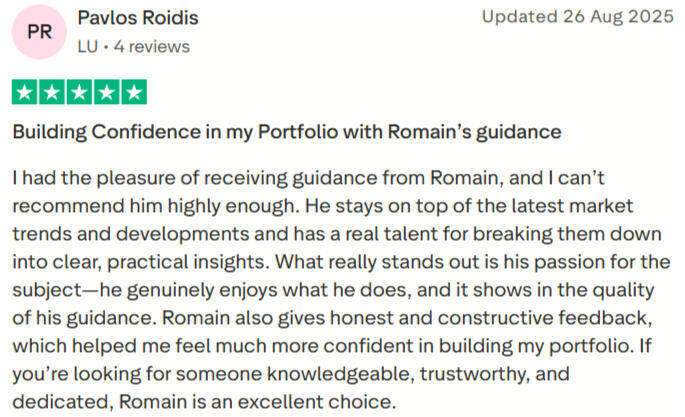

Romain Lucas, Founder, Smart Money Growth

I believe you deserve better. I believe the knowledge to confidently manage your own capital shouldn't be a closely guarded secret or require navigating a predatory system. It should be accessible, transparent, and empowering.

So I quit. and founded Smart Money Growth

Smart Money Growth is build to be the unconflicted, evidence-based alternative I wished existed when I started. My mission isn't to manage your money, but to give you the clarity and frameworks to become the sovereign architect of your own wealth.We do this through pure education, on ETFs, passive investing, and personal finance. The practice is built on a single, non-negotiable principle: zero commissions, zero conflicts. My only incentive is your success – equipping you with proven principle and models so that lets you be the steward of your own capital.

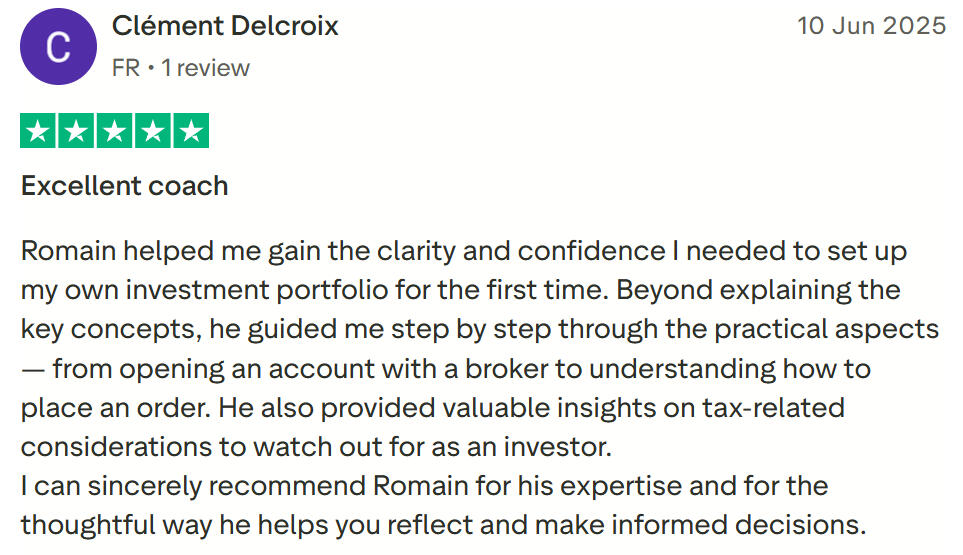

A Proven Evidence-Based Practice Founded in Luxembourg

Our Growing Community of Rational Investors

Frequently Asked Questions

Are you Ready to take the next step?

The Clear & Simple Path (0% → 90%)

The Optimized Path

(90% → 99%)

© Smart Money Growth. All rights reserved. Smart Money Growth and Romain provide financial education and mentoring services. We do not provide investment advice, individual recommendations, or manage investments on behalf of clients. The information shared on this website, the guide, during workshop/strategic sessions, mentorship sessions or through any other content is for informational and educational purposes only. It is not intended to constitute legal, tax, or investment advice, nor an offer or solicitation to buy or sell any financial product. Each individual is responsible for their own investment decisions. If you require personalized financial advice, please consult a licensed financial advisor or other qualified professional.